School choice advocates hope legislation that would establish a tax credit for donations to scholarship-granting organizations will be part of end-of-session negotiations

By Maria Wiering

“Parents should really make the decision of what is the best educational setting for their child,” said Chas Anderson, executive director of Opportunity for All Kids, or OAK, a nonprofit that advocates for school choice. “What we’re saying is that parents should have a wide range of options.”

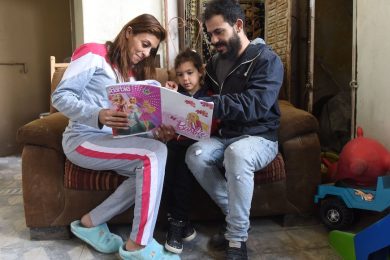

Introduced Feb. 28, the Equity and Opportunity Scholarship Act (S.F. 1872/ H.F. 1894) would provide individuals or corporations with a state tax credit of 70 percent of a donation to a qualified scholarship-granting organization. Parents who do not earn more than twice the income eligibility for reduced priced lunch — around $90,000 a year for a family of four, according to OAK — could apply to the scholarship-granting organizations to help their children attend Catholic and other private schools.

The legislation would expand low- and middle-income families’ opportunity to choose the best school for their child, advocates say.

The bill’s chief author in the Senate is Sen. Roger Chamberlain (R-Lino Lakes), chair of the Senate’s Taxes Committee, which held a hearing on the bill March 19. The bill was amended and slated for possible inclusion in the omnibus tax bill.

Among the Senate version’s four co-authors is Senate Majority Leader Paul Gazelka (R-Nisswa). Following the March 19 hearing, Chamberlain and Gazelka spoke at a news conference about the bill.

Standing against a background with the OAK logo and surrounded by students wearing yellow scarves, Gazelka said the bill “is a tool we hope to use to close the disparity gap among some of the schools that we have in Minnesota.”

He said Minnesota has one of the largest achievement gaps — “if not the largest achievement gap” — in the country. Standardized testing and other measures show a large disparity in public schools between students of color and their white peers.

“The Opportunity Scholarship will break down financial barriers for low- and middle-income families, allowing them to select the best schools based on the needs of their sons and daughters,” Gazelka said.

Attending the hearing and news conference were students from Ascension Catholic School, Risen Christ Catholic School, St. Helena Catholic School and Torah Academy, all in Minneapolis.

“What we’re really talking about is what’s best for kids,” said Ascension Principal Benito Matias at the press conference.

Rep. Ron Kresha (R-Little Falls) is the author of the companion bill in the House, where it was referred to the Education Policy Committee and has yet to be scheduled for a hearing.

Opponents of the legislation say a tax credit to help students attend private schools would divert funds that could help public schools. They have also expressed concern over improving access to schools with less state control than public schools.

However, most studies on school choice have shown that students who use scholarships to attend non-public schools improve their test scores. Other studies have shown school choice improves school racial and ethnic integration, and that school choice programs correlate with an improvement in public school test scores, too.

Anderson said because tax credits are being used to fund the scholarship-granting foundations, “you have to make several jumps to make that inference that somehow public education is not getting this money.”

“If they (legislators) decided not to fund this tax credit, it doesn’t mean that that money is going to go into education,” she said, noting that tax credits are widely used to fund initiatives.

She added that the point of the legislation isn’t to pit public against private education, but to expand parents’ options for their children’s education.

“Those parents pay taxes, and we should provide high-quality options for students in the public, charter and private sectors, and just let parents decide,” she said.

Similar legislation to the Equity and Opportunity Scholarship Act has been passed in about 20 states, and its constitutionality has been upheld in court, Anderson said.

The legislation would cap the amount individuals and corporations could donate annually; married joint filers, for example, would be limited to a $21,000 tax credit for a one-year donation of $30,000, and corporate filers would be limited to a $105,000 tax credit for a one-year donation of $150,000.

It would also cap the program’s overall annual donations at $35 million for tax year 2020.

The bill also excludes the participation of for-profit schools, and it would require participating schools to adhere to the state’s Human Rights Amendment and administer an approved reading and math assessment in certain grades.

With the exception of small changes reflecting the modified federal tax structure, the legislation mirrors a bill introduced during the 2017 session, Anderson said.

Although Gov. Tim Walz has said he will not support the legislation, Anderson said she feels hopeful about its passage because Gazelka has made advancing it a priority.

“We know that school choice initiatives basically take a multi-year effort,” she said. “It really comes down to end-of-session negotiations between the Legislature and the governor.”

Federal legislation has been introduced to create similar scholarships, but Anderson is not optimistic about its passage. That legislation also puts the decision whether or not to implement the bill in the hands of governors, which she said is ineffective tax policy.

Statewide survey results show school choice has bipartisan support among voters, particularly among minority communities, Anderson noted.

Among OAK’s member organizations is the Minnesota Catholic Conference, the public policy voice of the state’s Catholic bishops. In addition to faith-based communities that have traditionally supported the bill, education advocacy organizations EdAllies and Minnesota Comeback have added their backing, Anderson said, which allows OAK “to show more broad support in the community for the tax credit.”

Action Alert: https://www.votervoice.net/MNCC/campaigns/64428/respond