Submitted by the Minnesota Catholic Conference, the official public policy voice of the Catholic Church in Minnesota

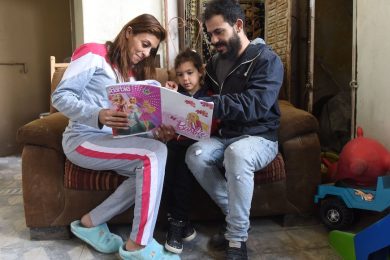

The Families First Project is an advocacy campaign of the Minnesota Catholic Conference to remove economic roadblocks that Minnesotans confront along their journey of forming and raising a family. This week’s column focuses on one Families First policy proposal that would make life a bit easier for new parents by reducing the tax burden they encounter when purchasing necessities for their newborn baby: a sales tax exemption on baby products.

Unnecessary barriers to family formation

When a young couple is considering whether to start a family, there is no doubt that the start-up costs on items like car seats, cribs, and strollers, are daunting. Families are facing skyrocketing costs on necessities of living, and no one is facing these high expenses more than families with infants. On average, a new parent may spend between $12,000 to $20,000 or more on their baby in the first year of his or her life. First-time parents face the largest upfront costs as they acquire essential items for their infants.

Minnesota cannot afford to lose young families who will support and sustain our well-documented aging population. Minnesota is facing a demographic cliff; we have not had replacement fertility levels since 2006, according to the Minnesota State Demographic Center. With these increasingly low birth rates, offering a small but impactful solution to families, like eliminating the state sales tax on essential baby items, could help lessen some of the fear felt by prospective parents. The state’s $17.6 billion surplus in 2023 demonstrates that we can afford to support growing families, especially low-income families who are most impacted by sales tax.

One solution: eliminating the state sales tax on essential baby items H.F. 2125 (Engen) / S.F. 2182 (Coleman) is a bipartisan bill that would expand the state sales tax exemption for certain baby products. Specifically, this proposal would put families first by adding baby wipes, cribs, bassinets, crib and bassinet mattresses, crib and bassinet sheets, changing tables, changing pads, strollers, car seats and car seat bases, baby swings, bottle sterilizers, and infant eating utensils to list of tax-free items that are considered essential.

A quick search of places like Amazon and Target reveals, on average, a parent will spend nearly $2,000 on the items covered by the exemption expansion—with the sales tax on the items totaling about $130. Although $130 out of nearly $2,000 does not seem like an overwhelming number, it can make a difference in the lives of new families. With those savings, the parents could in turn purchase their crib mattress and sheets, or nearly pay for a changing table. Eliminating this tax on the big-ticket items is particularly vital for lower-income families who are often living paycheck-to-paycheck and are more impacted by inflation and sales tax.

Action Alert: Support a Child Tax Credit

Another great bill to support families raising minor children is the creation of a state child tax credit, offering a tax rebate for each child (H.F. 1369/S.F. 1754). We all know families are doing the hard work of raising the next generation amid immense economic pressure. For this reason, families should be the first recipients of economic relief. You can help get a robust child tax credit passed into law by contacting your legislators today. Send them a message by visiting MNCatholic.org/actionalerts.

(Photo: Adobe Stock)